Challenge

To develop a payment aggregator for integration with a large number of acquiring banks and processing centers, supporting various payment methods, detecting suspicious transactions, and securely storing payment and personal data.

Solution

A dedicated development center at Axmor created a complex software solution for payment processing. It consists of three components: a payment aggregator, data vault, and anti-fraud system. This software allows retailers and online store owners to accept payments for goods and services from customers.

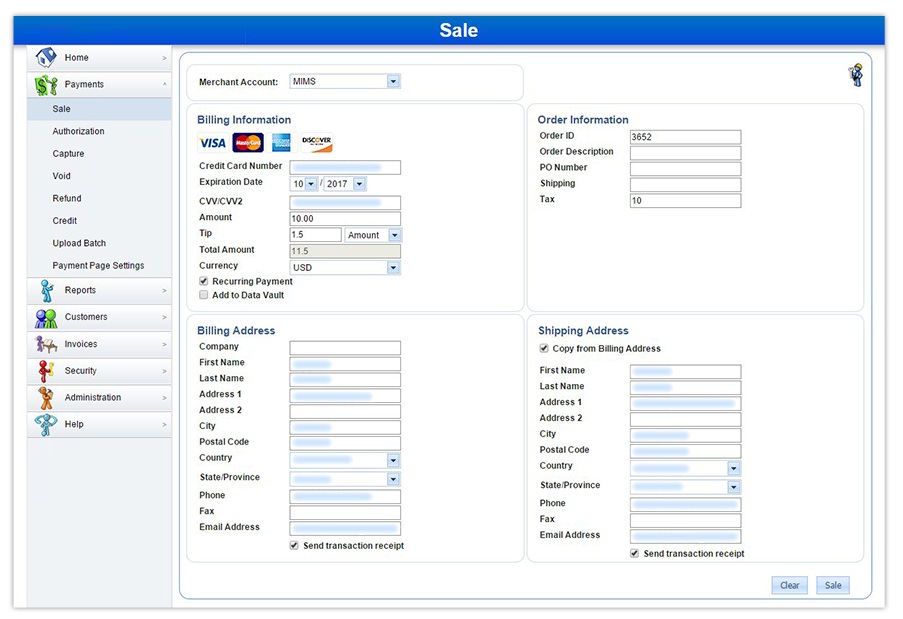

The payment aggregator allows retailers and online store owners to accept all major debit and credit cards and to support the following: Authorization, Sale, Capture, Void, Refund, Credit, and Settlement transactions.

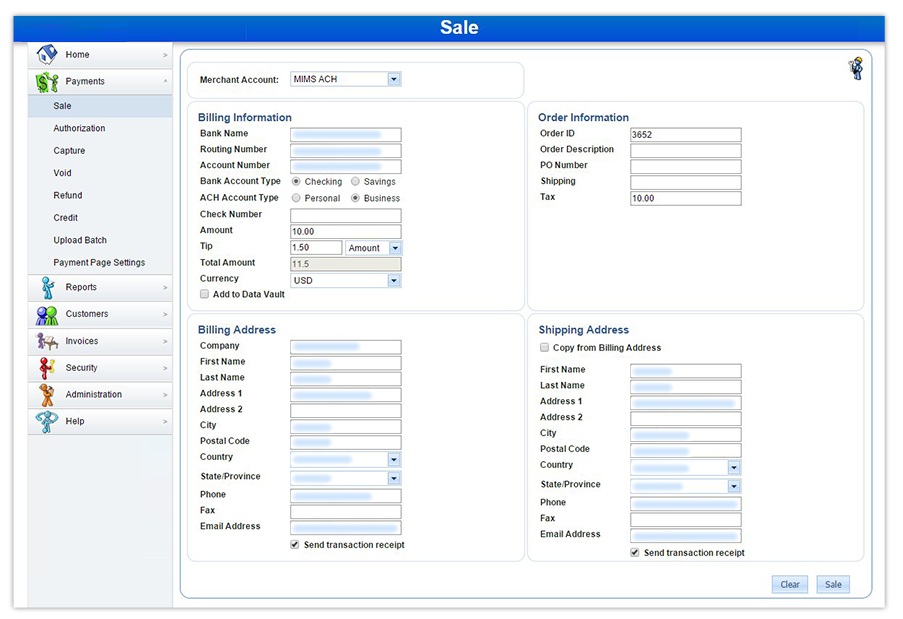

In addition to bank cards, the payment aggregator also supports payment methods such as checks, ACH, Star Card, e-wallets, and PayPal.

As the payment aggregator is integrated with over 30 processing centers and acquiring banks, retailers and online store owners can choose from a wide variety of partners.

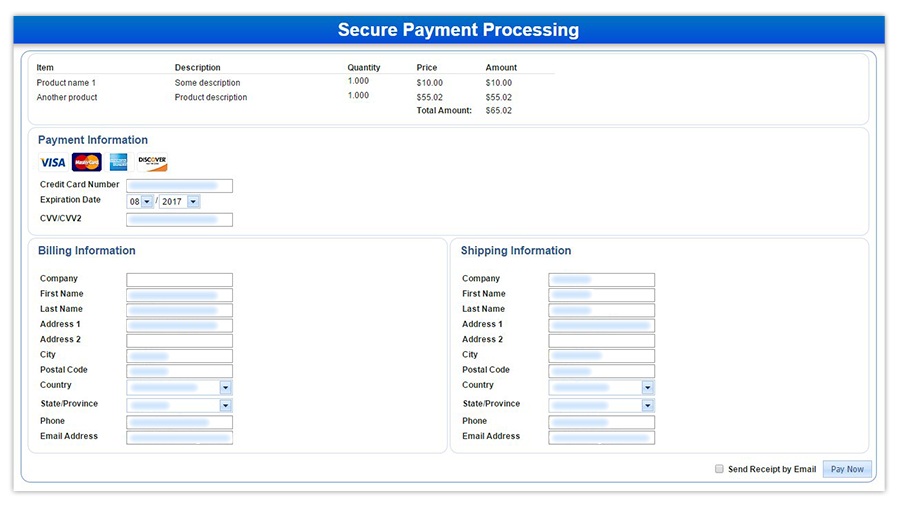

The convenient API allows the payment aggregator to be integrated with the POS terminals of various manufacturers, online stores, and mobile payment applications.

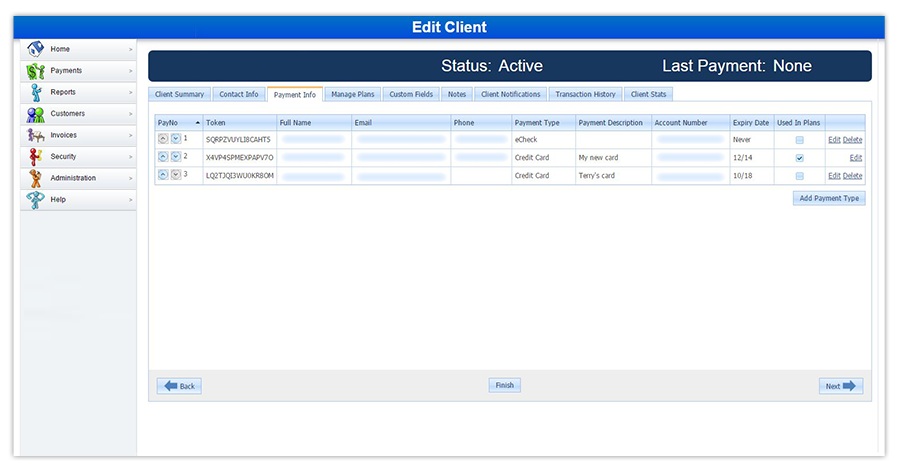

We developed a data vault to securely store payment and personal data such as bank card numbers, account numbers, addresses, phone numbers, email addresses, and other client information in full compliance with the Payment Card Industry Data Security Standard (PCI DSS). This solution stores payment and personal data of clients for retailers and online store owners so they do not have to go through the complex and expensive PCI DSS compliance certification procedure. It also minimizes risks associated with data storage.

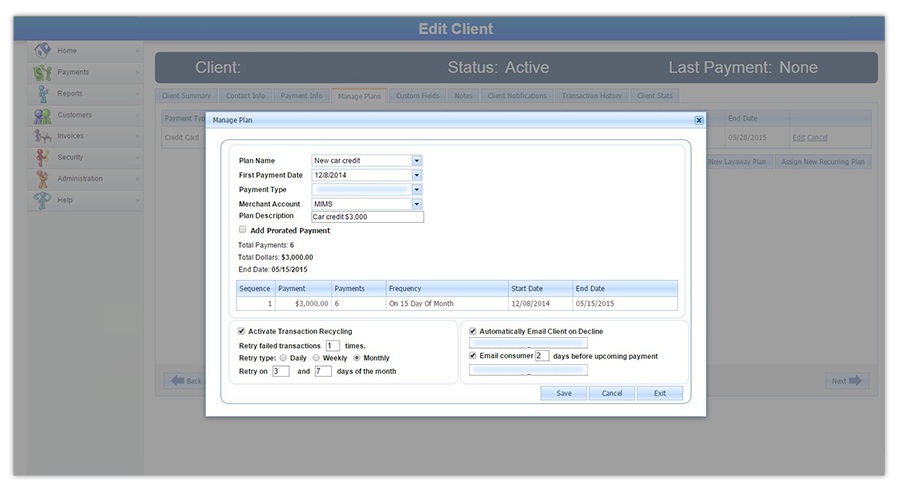

The data vault automatically processes recurring payments that are transactions executed at certain intervals and with fixed amounts for specific beneficiaries (for subscriptions to services or goods, for example). To ensure the payments are secure, we employ tokenization to manage payments.

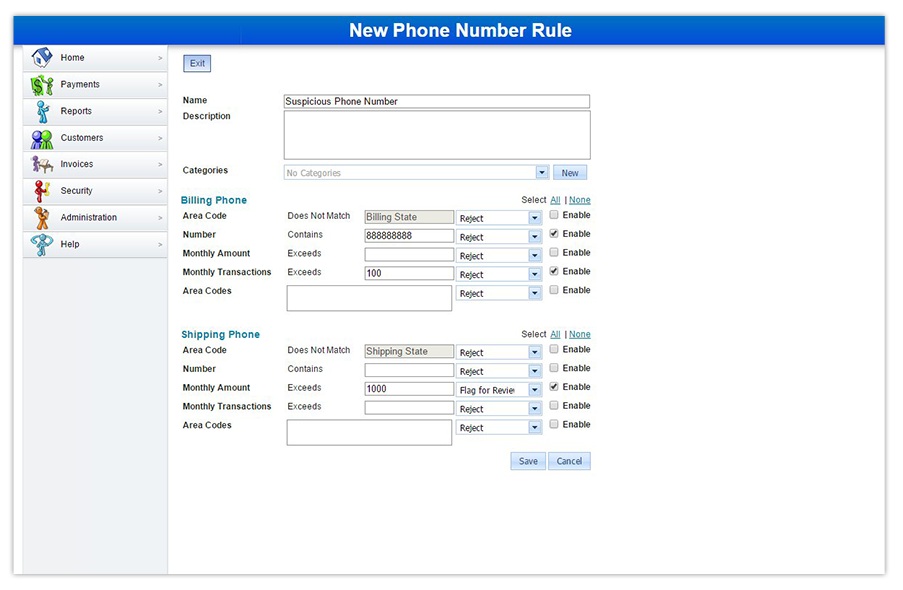

Axmor developed an intelligent anti-fraud system that monitors payments in real time 24/7 and can detect and reject suspicious transactions. The system uses 3D secure verification, blacklists of credit cards, countries, phone numbers, and IP-addresses; and customer scoring (a heuristic analysis of average activity for each client) to analyze transactions. Additionally, retailers and online store owners can easily configure their own algorithms for identifying suspicious transactions.

- The payment aggregator, data vault, and anti-fraud system are fully compliant with the Payment Card Industry Data Security Standard (PCI DSS) and Payment Application Data Security Standard (PA DSS).

- The dedicated development center at Axmor provides technical support 24/7 for the payment aggregator and payment verification. The center provides administration services for servers and databases and promptly addresses critical problems.

- The performance of the payment aggregator has been significantly improved due to mirroring and segmentation of the servers and databases.